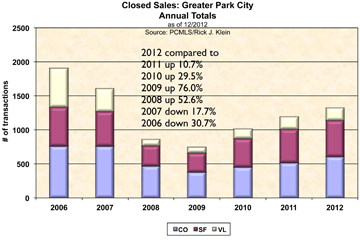

2012 proved to be a strong year! The Park City real estate market saw a strong increase in demand, lower inventory levels, and an increase in pricing.

Park City also stayed in the forefront nationally – awarded two top rankings. Park City’s three resorts (Deer Valley Resort, Canyons Resort, and Park City Mountain Resort) rank in Top 10 in SKI Magazine Reader Survey. The International Mountain bicycling association (IMBA) awarded Park City a gold level ride center, which is the first and currently only gold level ranking in the states.

2012 Park City real estate market highlights include:

- Closed sales up 10.7%

- Total listings decreased 3.4%

- 8 month inventory supply (excluding lots)

- Distressed sales down 13.5%

- Median price up 4.1%

- Average price up 2.1%

- Number of transactions up 11.7%

Demand is strong

Closed sales are up 10.7% from last year.

Declining Inventory Supply

Total listings decreased to 1,201 as of January 1st, 2013, a decrease of 3.4% from December 2012; down from 1,497 listings on January 2012. Based on an average of the past three month sales, this represents a 10.2 month supply; excluding lots an 8.0 month supply. This is the lowest housing supply since the Park City MLS began systematically tracking active/pended listings in January of 2007.

Declining Distressed Sales

For Q4 2012, distressed sales accounted for 13.0% of total sales (6.8% REO and 6.2% short sales), down from 13.5% for Q3 2012 and 31% for Q4 2011. Distressed sales sold for a discount of 3.3% off of market sales.

Prices show appreciation

Median price in 2012 is up 4.1% higher than 2011. The average price in 2012 is up 2.1% higher than 2011. The number of transactions in 2012 is up 11.7% higher than 2011.

Condominiums in area 10-23 (Canyons, Sun Peak Silver Springs, Old Ranch Road, Kimball, Pinebrook, Summit Park, Jeremy, Glenwild/Silver Creek, Trailside, Promontory, Jordanelle), median price is up 14.3% higher than 2011. Single family homes in area 1-9 (Old Town, Thaynes, Lower Deer Valley, Deer Crest, Upper Deer Valley, Empire, Aerie, Prospector, Park Meadows), median price is up 7.5% higher than 2011. Vacant land in area 10-23 (Canyons, Sun Peak Silver Springs, Old Ranch Road, Kimball, Pinebrook, Summit Park, Jeremy, Glenwild/Silver Creek, Trailside, Promontory, Jordanelle), median price is up 46.8% higher than 2011.

Utah Overall

Utah four-quarter appreciation increased 8.6%. U.S. four-quarter appreciation increased 4.0%

Park City Real Estate Market Review Stats provided by Rick Klein, Wells Fargo Home Mortgage.

Patrick Howell & Craig Popa